Transposition error is an error that occurs when digits are reversed while recording them. Generally, businesses prepare trial balances at the end of each reporting period. But, you don’t need to wait that long to spot a transposition error. If you unearned revenue notice two accounts are unequal, you should take action immediately. Now that you know what is transposition in accounting, you might wonder where these errors can occur. Transposition accounting might creep into your journal entries, business ledger, financial statements, or invoices.

Taking on New Clients During Tax Season

- Find the difference between total debits and credits, add 1 to the first digit of the difference, and you have an amount we will call X.

- Transposition errors can be a frustrating and costly mistake that occurs when numbers or letters are mistakenly reversed or rearranged.

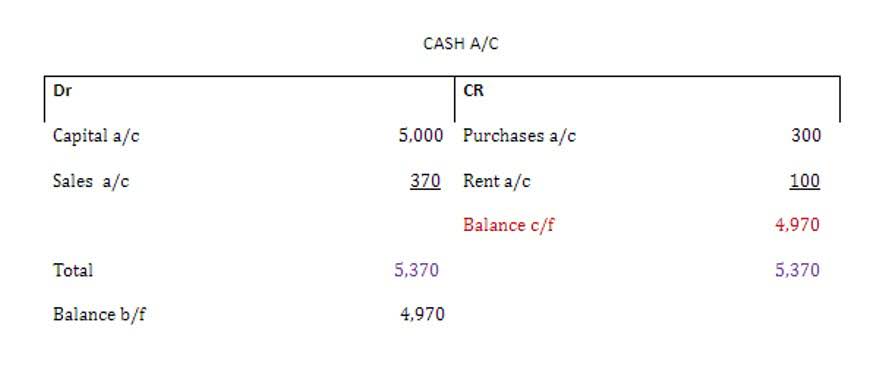

- Every transaction must have at least one debit and one credit, and the sum of debits and credits must always be equal.

- And although the aforementioned mistakes are typically easily remedied, in some cases, transposition errors relating to medicinal dosing information may lead to tragic consequences.

- Ask a question about your financial situation providing as much detail as possible.

- There are a number of tax forms where you could make transposition mistakes, including your small business tax returns and payroll tax forms.

For example, a business may be saddled https://www.facebook.com/BooksTimeInc with an increased tax liability if the transposition error is large enough to slingshot that company into a higher tax bracket. Of course, this largely depends on the degree of error in question. If a bookkeeper mistakenly writes $24.74 instead of $24.47, the resulting $0.27 discrepancy would hardly be consequential. On the other hand, if $1,823,000 were accidentally recorded as $1,283,000, the resulting $540,000 error is sure to have a profound financial ripple effect. Imagine how common transposition errors were before businesses maintained their books using software.

Stay up to date on the latest accounting tips and training

- The Motley Fool Ascent is 100% owned and operated by The Motley Fool.

- These errors can lead to incorrect calculations, skewed trends, and erroneous conclusions.

- When your debits and credits don’t match, you might have a transposition error on your hands.

- But, you transpose the numbers and debit your Accounts Receivable account $1,180.

Transposition errors made in the trading world are sometimes called “fat-finger trades.” In one famous example, a Japanese trader accidentally ordered 1.9 billion shares in Toyota. Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial. This is one transposition error that’s going to require retro pay. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market.

What is your current financial priority?

- A payment of $89 was journalized for a telephone bill as a debit to a telephone expense account by $98.

- To correct an erroneous transaction, you’ll need to record an additional transaction involving the same accounts.

- After I finish processing all the invoices, I produce an accounts payable aging report for your review.

- But, you don’t need to wait that long to spot a transposition error.

- Transposition errors may also occur when checks are filled out incorrectly, resulting in improper payment amounts that can cause overdrafts and other banking issues.

No matter what set of numbers you compare, if you transpose digits, the difference between the two numbers will be evenly divisible by 9. Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- While this method is time-consuming and prone to human error, it can be useful for small datasets or when other tools are not available.

- In my fatigued stupor, I open the accounting software and start charging through the bills.

- The best way to correct a transposition error is to make a debit entry to cash by the amount of the error and a credit entry to the account with the incorrect balance by the amount of the error.

- This type of accounting error is easy to make, especially when copying down transactions by hand.

- Bankers, for example, are well aware of the transposition rule and divisibility by 9.

Error of Transposition

During the process, match every transaction to source documents, such as receipts and invoices. what is one way to check for an error caused by transposed numbers? I record the following correcting journal entry to decrease both the utilities expense and accounts payable by $45. When your debits and credits don’t match, you might have a transposition error on your hands. Trial balance errors cause inaccuracies on your balance sheet and income statement.